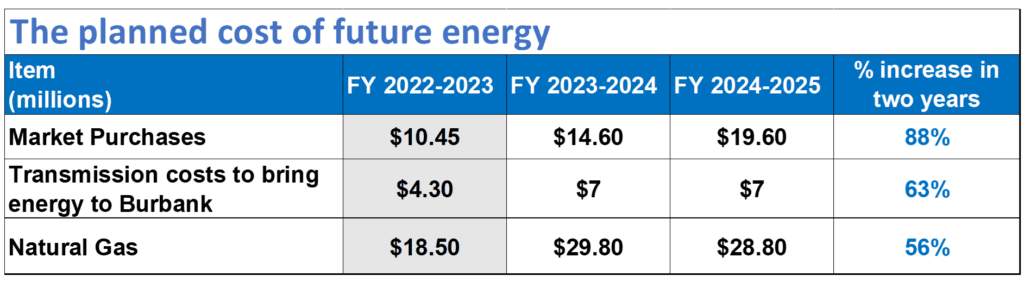

Learn how changes in energy prices are contributing to the proposed 8.5% (Fiscal Year 23/24) and 8% (Fiscal Year 24/25) increase in electric rates.

Just like a family pays for natural gas to keep warm or uses rooftop solar to power their home, BWP uses different energy sources to power our community. Those energy resources are changing as BWP makes its way towards 100% carbon-free resources by 2040 and manages the grid to ensure Burbank is energized 99.999% of the time. Delivering a reliable, affordable, and sustainable supply of electricity every time a switch is flipped is a complex process requiring management of available electricity sources, real-time energy cost analysis, location, and ultimately transmission. At BWP, a team of highly skilled energy specialists navigates this complex landscape to bring the power needed to keep Burbank’s lights on.

In the past three years, power prices have been increasing to the highest we’ve seen in recent memory. It has been a perfect storm of issues that have caused an increase in price across all our resources–from coal to natural gas to renewables. Supply chain issues, labor constraints, and inflation have all contributed to increased costs.

The issue with coal – a fire in the coal mine

Historically, coal supplied the majority of Burbank’s energy because we have a long-term contract that has not expired. This inexpensive contract will end within the next several years and has been used to help ensure we can stabilize rates at times when energy is most expensive. This last year has been different. On Sept. 21, 2022, the Lila Canyon Coal Mine, which is the largest source of coal supplied to our Intermountain Power Plant (IPP), caught fire. The fire continued into December and deliveries from this coal mine ceased. In addition to this, there were major supply chain issues and labor shortages for truck drivers and rail engineers to deliver coal to the generation site. Deliveries from other smaller sources continued, but coal deliveries to IPP were significantly reduced. The impact of this is that BWP can only access 11MW of energy from this source, rather than our 89MW allocation. This means that we must get energy from other places, and the next cheapest source is natural gas.

The issue with gas – as other resources become unavailable or too expensive, we all turn to gas

Consumers who use natural gas saw a 200% spike in gas prices this winter, but BWP saw an increase in spot market natural gas prices of approximately 350% between December 1, 2022 and February 13, 2023. Typically gas prices in the winter are low and help offset the high cost of gas in the summer. That didn’t happen this past winter, when the entire U.S. saw some of the coldest temperatures of the decade and natural gas companies saw usage considerably above normal. In addition to increased consumer use, utility companies were also looking for gas due to the coal shortage. Demand for natural gas was much higher than supply so energy prices went way up. In addition to gas going up over 3.5X, we saw the cost of buying any energy on the spot market go up as much as 5X normal prices.

BWP is mitigating increasing power costs, as much as possible. We are in the process of hedging our natural gas supply, to buy natural gas for both FY 23-24 and FY 24-25 at a set cost. This will limit our exposure to the volatile natural gas market. In addition, we will use any excess transmission and energy and sell it in the wholesale market to increase revenues and offset power costs. Even with these efforts, the costs will still be high.

Staff has seen a 60-200% increase in the price of long-term renewable energy contracts — this includes wind, solar and geothermal resources. However, we are aggressively pursuing renewable contracts to ensure we meet the state mandated sustainability target of 60% renewable resources by 2030 and the BWP goal of 100% carbon free resources by 2040.

What if we don’t raise rates and just wait to see what happens?

BWP expects to under-collect $21 million in the electric fund by June 30, 2023, mostly driven by power costs. Energy markets have been so volatile that it is easy to think that we can take on a strategy to wait this out until we see prices reduce. We tried that strategy and have used up a lot of cash. Hopes to replenish our expenditures when prices come down have not been realized. That plan is not working out and we must increase our rates responsibly to ensure we manage a financially healthy utility. One of the largest factors to this deficit was the 10-day heat dome in September 2022, with temperatures over 100 degrees across the west. In that month we needed to run our own gas-powered Magnolia Power Project (MPP) and Lake One unit more at extreme gas prices to keep the lights on.

As your not-for-profit community-owned utility we want to ensure you understand the drivers of our cost increases. BWP strives to provide transparency in our budget proposals and manage the impact of rate increases on our most vulnerable customers. We will continue to do so on April 6, 2023 at the BWP Board Meeting, on May 9, 2023 at the City Council meeting, and at the June 6, 2023 public hearing on rate increases.

This year, BWP is proposing an electric rate increase of 8.5% in 2023/24 and 8% in 2024/25, which will help cover the costs of power and other increases. If a rate increase will present a significant struggle to your household, BWP has a suite of programs to help manage bill increases, regardless of income level. For more information about our financial help programs, please visit our website or contact us at (818) 238-3700.

The price of energy is going up for one reason, one reason only: The Biden admin.’s policies. The country was energy independent under Trump. Biden put a stop to tht on day one of his admin. Biden is a puppet of China and is doing their bidding. That should be clear to every American by now. We are being sabotaged by our own President.

I am calling for an independent audit of the BWP. I have observed waste and mismanagement at every level. Some obvious wasteful items are:

1) Free food for employees and board members.

2) Free electricity for employees and board members to charge electric cars.

3) Giving away free space and electricity to build the float for decades.

4) Having multiple city vehicle repair yards. (Not counting a separate vehicle repair facility for the school district.)

5) A wasteful and redundant travel program for the top BWP officials.

6) Holding meetings the public can’t attend in violation of the Brown Act by locking the front door of the building at the exact moment the public meeting starts. (No, Ms. Lindell, you cannot bastardize the word ‘open’ to suit your needs.)

7) Having employees that are making OVER $500,000.00 per year and allowing apparently unlimited overtime to people doing dangerous jobs. By allowing tired, overworked employees to work without rest is creating a recipe for disaster.

And the list goes on and on.

We have poor management that is wasteful, and resistant to change and criticism.

We have a seven member appointed board that is not interested in hearing from the public ratepayers. The proof – they restrict public comment to three minutes while other boards and commissions give you five minutes to speak. In my observations of the meetings, public comments are routinely not responded to and ignored.

The BWP should welcome and invite an outside, independent review. What have they got to hide?

Comments are closed.